409A – A Guide for Startups

We “Get It”

We understand that the last thing any start-up wants to worry about is tax compliance, especially when you have so many other things to worry about. Like product development, sales, recruiting, etc.… But it is wise for a start-up to think about compliance early on to avoid potential penalties and distracting complications from lack of compliance later down the road. If you don’t know about an issue ask a professional like your lawyer, accountant, etc.…here is a little background on 409A valuations and choosing the right 409A provider.

What is 409A?

409A refers to Section 409A of the Internal Revenue Code for the Internal Revenue Service (IRS) of the United States of America. This code governs the taxation of non-qualified deferred compensation. Section 409A was added to the Internal Revenue Code in January of 2005 and issued final regulations in 2009.

Stock options give employees, consultants, etc. (any grantee) the right to buy stock at a predetermined price (the strike price). But you first need to determine what the strike price should be. The IRS 409A regulation stipulates the strike price must be equal to the Fair Market Value (FMV) of your company’s common stock.

But how do you value the company stock, especially if the company has a complex capital structure (i.e. has raised money via equity or debt)? Third party valuation firms with experience in these valuations are your best bet for staying compliant. But be careful. Not all firms are created equal.

There are three “safe harbor” methodologies provided by the IRS regarding setting the fair market value (FMV) of common stock for privately held companies. Almost all VC or angel-backed startups follow will use a third-party firm and follow the Independent Appraisal Presumption: A valuation performed by a qualified third-party appraiser. The valuation is presumed reasonable if the valuation date is set no more than 12 months prior to an applicable stock option grant date and there is no material change from the valuation date to the grant date. If these requirements are met, the burden is on the IRS to prove the valuation was “grossly unreasonable.” If the valuation does not fall under “safe harbor” then the burden of truth falls on the taxpayer.

There are severe penalties for Section 409A violations which include, immediate tax on vesting, additional 20% tax penalty, and penalty interest.

So why is safe harbor important and how you can get it?

Ideally, safe harbor insulates you from persecution. Luckily, IRS has provided avenues for companies to safely offer deferred compensations. If you have a safe harbor, IRS will only reject the valuation if they can prove that it is grossly unreasonable. The burden of proof is with IRS to prove that you are in error. However, this burden of proof is shifted to the company and BOD if don’t have safe harbor. In this case, you are treated as having granted cheap stock unless you can prove otherwise and defend your strike price.

For the valuation to be treated as safe harbor valuation, it must be done in any of the following ways, but we will focus on the first two.

Valuation be done internally by a qualified staff

Valuation be done by a qualified third-party valuation company

Stock be offered through a generally acceptable repurchasing formula

Using Internal Value

In this option, the company will appoint a qualified individual from the internal team to conduct the valuation. This can be one of the easiest and cheapest options, but it has several other conditions attached to it. The individual doing the valuation and the company must meet set standards.

The individual appointed to do the valuation must have at least five years’ experience in a field related to valuation. This includes business valuation, private equity, investment banking, secured lending, or financial accounting. This can be tricky because there is room for subjectivity. IRS, upon its discretion, may determine that the individual who did the valuation did not meet the required standards. Further, what we have seen too often is the internal valuation results in values way to high or just plain wrong. Experience matters.

Moreover, a company can only use this option if it can meet the following requirements:

- It is a private company

- Has no publicly traded stock

- Is less than ten years old

- Has no stock that is considered as a call, put, or similar derivative

Appointing a Third-Party Firm

While this may be the most expensive option, it is also the safest. The only condition is that the firm should follow consistent methodologies in the valuation. So, it is important to supply the firm with all the necessary information to carry out the valuation. The information includes the following.

With the requested information, a qualified firm can do a reasonable valuation. In some instance, a third-party firm may arrive at a favorable fair market value without going too low to raise alarm. The advantage of working with a third-party firm is that you get double protection. Most firms will be interested in saving their reputation, so they are more likely to protect you. Moreover, the burden of proof lies with IRS.

The Dangers of Working with Non-independent Valuation Firms

For a company to be deemed as independent, in IRS context, it should only provide you with valuation services. Some companies may be tempted to register a separate LLC company to handle valuations, but the conflict of interest is their regardless.

To qualify for a safe harbor, valuers must be seen to be independent. They should also employ objective judgment in arriving at their conclusion. In this case, there should not be any conflict of interest, and valuation should be based on merit, free of bias. Therefore, if a valuation company receives other forms of income that are not related to valuation from your company, then that amounts to a conflict of interest. There is even a bigger conflict of interest if the valuation firm offers liquidity to the same shares it is valuing.

Legally, conflict of interest indicates the presence of economic benefit. In that case, IRS requires valuation firms to declare that there have no relations with their clients. On top of this, they should also attest that the compensation is not based on the results they deliver. The bottom line is that you will not achieve safe harbor if is there is a conflict of interest.

So, when can you say you have fully achieved safe harbor?

If your valuation has respected all the requirements for achieving a safe harbor, then you are almost guaranteed of protection, but you are not off the hook yet.

The following caveats need to be taken into consideration:

- If there is material change that might have a direct impact on the value of the company, then the valuation will become invalid

- The valuation is valid for 1 year, so if you are issuing additional shares after 12 months, then you should do a new valuation

- IRS still has room to determine if the valuation was grossly unreasonable

It may seem like a daunting task to do 409A valuation the right way, but it is worth the effort because the consequences for violations are severe. Remember that safe harbor is the best way to protect yourself against harsh penalties.

How Do I Get a 409A Valuation?

In order to get a 409A valuation you want to work with a reputable firm that has experience in rendering valuation opinions. We recommend staying away from 409A only shops, firms that are not independent, or are “giving away” in conjunction with a software sale.

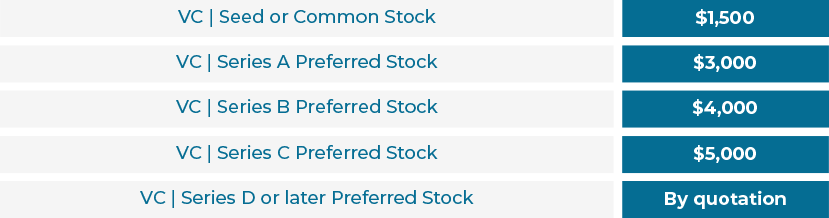

How Much Will a 409A Valuation Cost?

409As are relatively new. When they were first introduced in 2005, everyone scrambled to comply. Valuation firms were born into a world where they were desperately needed but without a precedent to set a price for their services. Since then, with more options becoming available, the costs have decreased. The DIY and qualified individual methods are typically more cost-effective, but significantly riskier, so if you want safety and a good deal, keep reading…

It can be difficult to know what market or fair prices for valuation services are if you have not had experience with these services before. Below we are presenting what we feel are middle of the road prices for quality service and reports with technical rigor that would pass a big four auditor. You can find cheaper, but you run all kinds of risk for your company, employees, and board.

No matter what, make sure you choose a valuation firm you trust and that you can see yourself having a good relationship with because that relationship may be a long one. If you’re ready to get your 409A valuation and start issuing stock options to employees.